Getting Started

Getting Started

The Devdraft Console is a web-based interface for managing payments, products, and integrations without writing code.

Accessing the Console

1

Navigate to Console

Visit console.devdraft.ai in your web browser.

2

Sign In

Use your Devdraft account credentials or create a new account.

If you’re part of an organization, you may need an admin invitation first.

3

Complete Setup

Follow the guided setup to configure your organization details.

Account Setup

Organization Information

1

Update Organization Details

Navigate to Settings → Business Details:

- Organization name

- Contact email

- Logo and branding

2

Configure Contact Information

Add support details visible to customers during checkout.

Key Features to Explore

Account Verification

Complete KYC verification to unlock all features.

API Keys

Generate and manage your API keys for integrations.

Payment Links

Create payment links for easy customer transactions.

Product Store

Set up your digital and physical products.

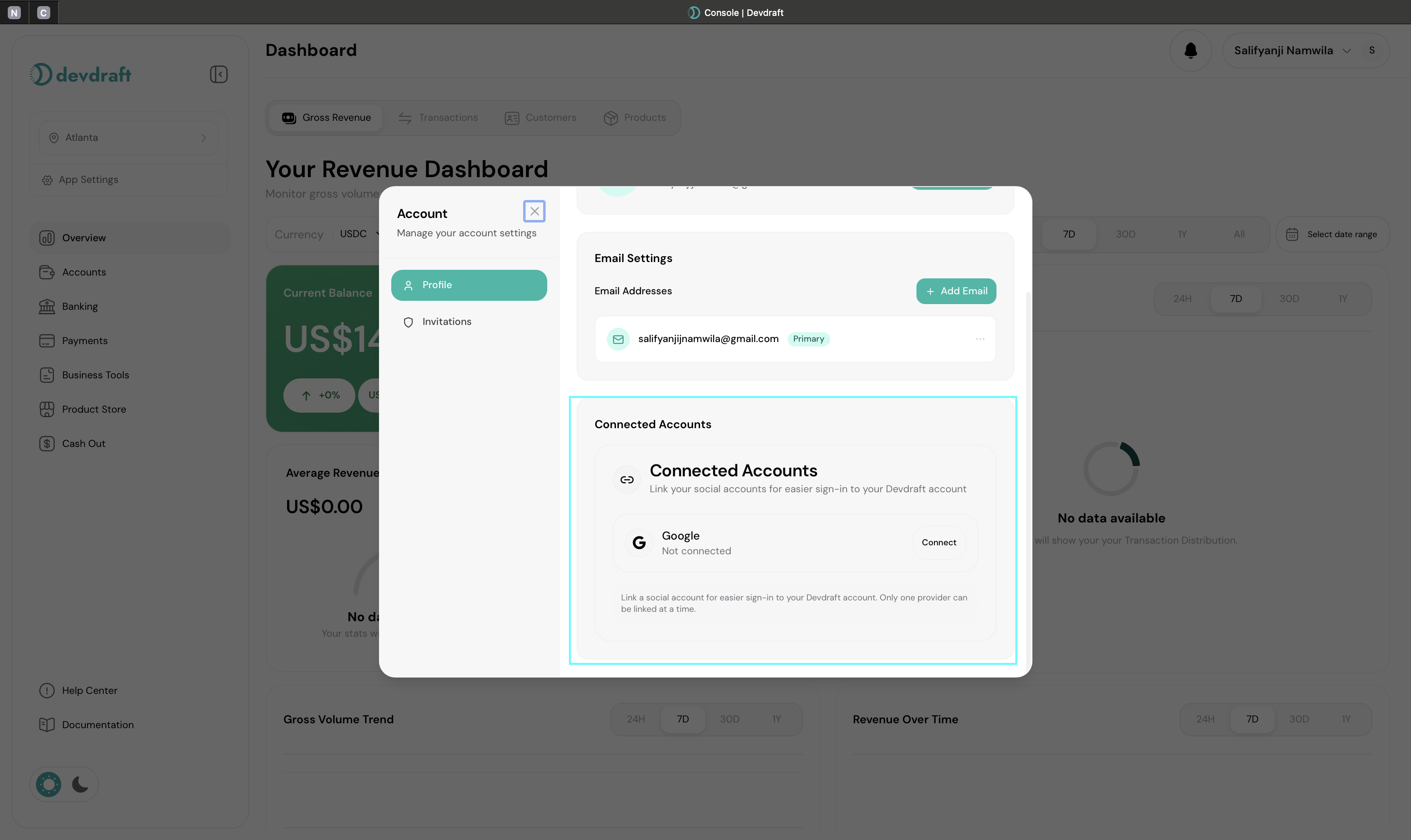

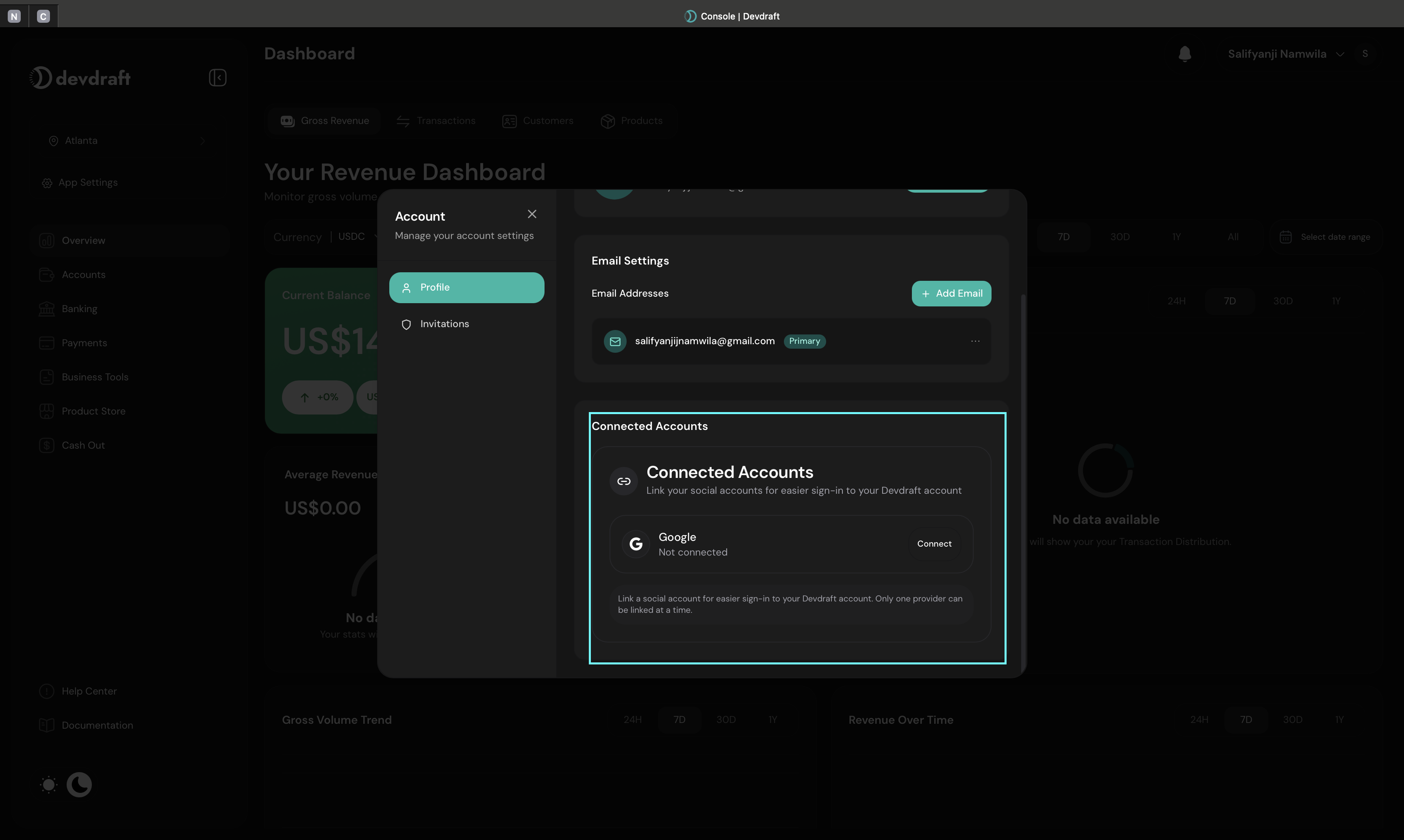

Authentication & Security Setup

Configure additional security measures and authentication options for your account.

Google Sign-In Integration

Need help? Contact support at support@devdraft.ai or visit our FAQ.